Why Sensitive Audits Require a Special Framework ?

Government auditing plays a key role in ensuring accountability and transparency in public institutions. However, when it comes to auditing sensitive areas — such as constitutional courts, military institutions, intelligence agencies, or national security entities — the process becomes significantly more complex. These institutions often operate with high degrees of independence and deal with classified or highly sensitive information that must be protected.

For government auditors, the challenge lies in conducting comprehensive audits that promote accountability without infringing on institutional independence or compromising national security.

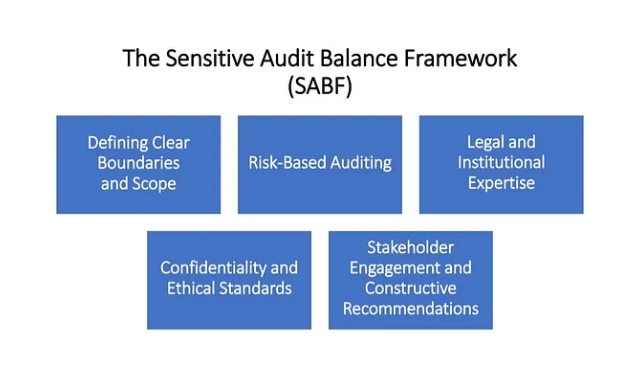

My recent study proposed the framework of Sensitive Audit Balance Framework (SABF) to deal with sensitive areas.

The Sensitive Audit Balance Framework (SABF) provides a structured, nuanced approach to auditing sensitive institutions. It ensures that while public funds are accounted for and efficiency is improved, the confidentiality and autonomy of the audited body are respected. This humble article introduces the SABF and explains how it addresses these critical challenges.

What Is the SABF?

The Sensitive Audit Balance Framework (SABF) is a systematic approach designed to guide Supreme Audit Institutions (SAIs) in conducting audits in sensitive areas such as courts, military organizations, intelligence agencies, and other institutions that handle classified or delicate information. It focuses on maintaining a balance between promoting transparency and respecting the independence and confidentiality of these institutions.

The author suggests that the framework is grounded in five key principles as follows.

1. Defining Clear Boundaries and Scope: Focusing on financial and operational aspects while avoiding interference with sensitive core functions.

2. Risk-Based Auditing: Prioritizing high-risk areas to ensure efficient use of audit resources.

3. Legal and Institutional Expertise: Understanding the legal frameworks governing sensitive institutions to avoid legal overreach.

4. Confidentiality and Ethical Standards: Ensuring the protection of classified or sensitive information.

5. Stakeholder Engagement and Constructive Recommendations: Collaborating with institutional leaders to promote transparency without compromising operational effectiveness.

Key Elements of the SABF

Defining Clear Boundaries and Scope

The first step in conducting an audit under the SABF is to clearly define the scope of the audit. Sensitive institutions such as constitutional courts or military organizations often have a distinct role that requires protection from external interference. Auditors must focus on financial management, administrative efficiency, and operational compliance, while avoiding intrusion into sensitive areas like judicial decision-making or national security operations.

For example, when auditing a constitutional court, the audit should focus on the use of public funds, budget compliance, and operational efficiency in managing case workloads.

The scope should exclude areas that could compromise the independence of judicial rulings or decisions.

Risk-Based Auditing

Sensitive audits must focus on risk-prone areas. A risk-based auditing approach prioritizes high-risk areas that pose the greatest threat to the institution’s operational efficiency or resource management.

For example, when auditing a military institution, auditors may focus on procurement processes, where the risk of fraud or inefficiency is high, rather than on operational strategies that might be classified.

Risk-based auditing ensures that the audit adds value without unnecessarily scrutinizing areas that don’t need intervention. It also allows auditors to focus their limited resources on areas where they can have the greatest impact.

Legal and Institutional Expertise

Auditors need to have a deep understanding of the legal and institutional frameworks that govern the audited body. Constitutional courts and military agencies operate under specific legal mandates that provide them with a degree of independence. Without a comprehensive understanding of these mandates, auditors risk overstepping their authority.

In the case of courts, auditors must ensure that they are only reviewing administrative and financial processes, leaving judicial rulings untouched. Similarly, when auditing military organizations, auditors should focus on resource allocation, procurement practices, and logistics, avoiding any analysis that could impact national defense strategies.

Confidentiality and Ethical Standards

Sensitive audits often involve access to classified or confidential information.

Protecting this information is critical.

The SABF emphasizes the importance of strict confidentiality protocols, ensuring that auditors respect the sensitive nature of the data they encounter. Auditors must sign confidentiality agreements and follow protocols to prevent any unauthorized disclosure of classified information.

The ethical responsibility to protect confidential data is paramount. Auditors must avoid any actions that could compromise the security or independence of the institution.

For example, auditors working with military institutions or intelligence agencies must ensure that sensitive operational details are kept confidential, even as they assess broader administrative and financial issues.

Stakeholder Engagement and Constructive Recommendations

The SABF encourages collaboration with stakeholders, such as the leadership of the institution being audited, to ensure transparency and build trust. Before the audit begins, auditors should engage in consultations with key stakeholders to define the audit’s scope and agree on boundaries. This ensures that the audit process is understood and accepted by all parties involved.

Furthermore, constructive recommendations are a core component of the SABF. Auditors must provide actionable and balanced recommendations that focus on improving financial management and administrative efficiency without interfering with the institution’s core functions.

For example, an audit of a constitutional court might suggest improvements in case management systems or budget allocation processes, without commenting on judicial independence.

Applying the SABF in Sensitive Areas

The Sensitive Audit Balance Framework (SABF) can be applied across various sensitive institutions, each of which presents unique challenges. Below are examples of how the SABF can be applied in specific contexts:

Auditing Constitutional Courts

- Focus: Administrative efficiency, case management, financial transparency.

- Challenges: Avoiding interference in judicial decisions.

- SABF Application: Focus on financial and operational performance while respecting judicial independence. Recommendations could include suggestions for improving resource allocation or streamlining administrative processes.

Auditing Military Institutions

- Focus: Procurement practices, budget management, resource allocation.

- Challenges: National security and classified information.

- SABF Application: Risk-based auditing with a focus on high-risk areas like procurement, while safeguarding operational secrecy. Recommendations might involve improving procurement transparency without discussing classified operations.

Auditing Intelligence Agencies

- Focus: Financial integrity, operational efficiency, compliance with laws.

- Challenges: Extreme sensitivity of information.

- SABF Application: Review of financial controls and resource use without accessing operational intelligence. Recommendations should focus on enhancing financial transparency and administrative efficiency.

Why SABF Is Critical for Sensitive Audits?

The Sensitive Audit Balance Framework (SABF) is designed to help auditors navigate the complexities of auditing sensitive institutions. By balancing transparency with the need to protect independence and confidentiality, the SABF ensures that audits add value without compromising the operational integrity of courts, military institutions, or intelligence agencies.

Auditors who use the SABF can deliver results that improve financial accountability and administrative efficiency, while maintaining trust with stakeholders and protecting the sensitive nature of the audited body. This framework is essential for addressing the unique challenges of sensitive audits and ensuring that public resources are used effectively without undermining the core functions of critical institutions.

Dr.Sutthi Suntharanurak